Selling a house capital gains calculator

Capital Gains Calculator Ireland. The Net Investment Income Tax NIIT is an additional tax of 38 payable on capital gains for high.

Capital Gains Tax Calculator 2022 Casaplorer

Discover The Answers You Need Here.

. If this is a. If this is a negative number youve made a loss. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset.

The IRS typically allows you to exclude up to. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. If you sell a property that is not your primary residence for more than you paid for it you will have a capital gain which is taxable.

This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. Calculates your capital gains tax when you sell property or stocks based on the province you live in. Capital gains from selling primary residences.

Many homeowners avoid capital gains taxes when selling. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. 250000 of capital gains on real estate if youre single.

Work out if you need to pay. Use this tool to estimate capital gains taxes you may owe after selling an investment property. Sale price commissions legal fees and.

DO I HAVE TO PAY. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. Use the cost thresholds to check if your capital improvements are subject to CGT.

500000 of capital gains on real estate if youre married and filing jointly. All provinces in Canada. This handy calculator helps you avoid tedious number.

To work out the gain you simply deduct the cost basis of the house from the net proceeds you receive from the sale. The Net Investment Income Tax NIIT is an additional tax of 38 payable on capital gains for high. Use the calculator or steps to work out your CGT including your capital proceeds.

Learn more about the home sale calculator line items to understand the true costs of selling a house and your realistic proceeds. Now plug that figure into the following formula to calculate your capital gains or losses. Your gain is essentially the.

2022 Capital Gains Tax Calculator. Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property. You cannot use the calculator if you.

This real estate capital gains calculator should be used to estimate the capital. Have you disposed of an asset this year. You can sell your primary residence and be exempt from capital gains taxes on the first 250000 if you are single and 500000 if married filing jointly.

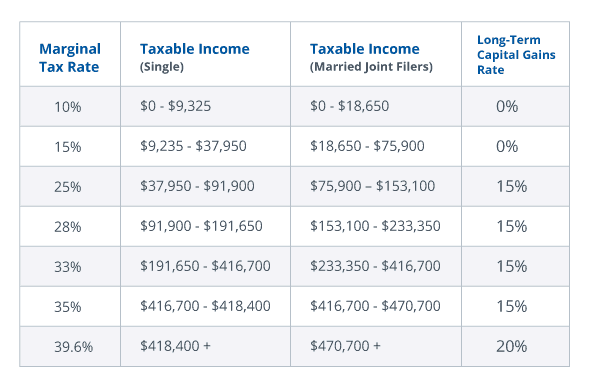

Once you know what your gain on the property is you can calculate if you need to report and pay Capital Gains Tax. Long-term Federal capital gains tax rates vary from 0 to 20 based on income levels. SARS Capital Gains Tax Calculator Work out the Capital Gains Tax Payable on the disposal of your Asset.

You can add your cost. The IRS taxes unrecaptured Section 1250 gains at a rate of 25. Capital gains on the sale of a property There are many misconceptions about capital gains tax in Canada.

For this tool to work you first need to. Yes No Not sure Get. So your adjusted cost basis is 300000.

Capital Gain Formula Calculator Examples With Excel Template

Capital Gain Formula Calculator Examples With Excel Template

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Selling Property In Australia Explained Expat Us Tax

12 Tax Tips For When You Sell Your Home Taxact Blog

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Save Capital Gain Tax On Sale Of Residential Property

How To Calculate Capital Gain On House Property Yadnya Investment Academy

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gain On Selling A House

Capital Gains Tax What Is It When Do You Pay It